It can be particularly challenging for company owners with poor personal credit to finance a new firm or support the expansion of an existing business.

Fortunately, negative credit business loans can increase access to funding, especially for less creditworthy consumers and start-up companies without a history of good credit.

To be eligible for bad credit business loans, prospective borrowers normally need to have a personal credit score of at least 500.

However, you shouldn't anticipate receiving the most advantageous conditions if your credit is harmed because business loan rates and terms rely on the qualification standards you fulfill.

If it so happened that you urgently need emergency cash immediately from a bad credit direct lender then you should seek help from 5 top specialized companies.

Finding a lender with a loan your credit score qualifies for, rather than one with the lowest rate or the best conditions, should be your objective if you have weak credit.

Learn more by visiting fit my money and reading the 5 best business lenders below.

5 Best Business Lenders For Bad Credit Scores

1. Fora Financial

Term loans are available through Fora Financial, an internet lender located in New York. Young yet established small enterprises seeking quick funding or borrowers who might not be eligible for typical bank financing may find Fora Financial to be a good fit.

These loans have a factor rate that runs from 1.1 to 1.9. There is no annual percentage rate used in pricing this credit. APR is used in finance when interest is charged on the principle, which decreases as payments are made.

Multiplying the factor rate by the loan amount yields the total cost of a Fora Financial term loan. A $10,000 loan, for instance, would need $11,000 in total repayment over a 12-month term with a factor rate of 1.1.

2. OnDeck

Online lender OnDeck provides business term loans and business credit lines. These small company loans are ideal for businesses that want immediate access to funds and may be utilized for several reasons.

OnDeck is renowned for its accommodating qualification standards and efficient underwriting procedure, enabling you to apply in just a few minutes and, in certain situations, get funding as soon as the same day.

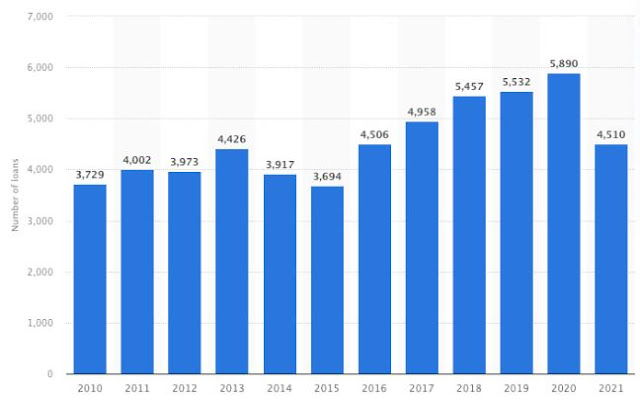

The SBA Microloan Program gave out 1,380 fewer microloans to small firms in the US in 2021 than it did in 2020. This suggests that it is much better to contact private loan companies that do not work for the government.

The term loan is suitable for one-time expenditures in your company, including creating a new location or remodeling your current facility, and is offered in quantities of up to $250,000.

The line of credit is a suitable choice for meeting working capital requirements, such as paying for payroll or purchasing merchandise, and it is offered in quantities up to $100,000.

3. Fundbox

A line of credit is available from Fundbox, an online lender, to business owners who urgently need to close a cash flow gap. You can get the line of credit as early as the following working day.

Fundbox is renowned for accommodating qualifying rules and providing finance to entrepreneurs with poor credit or little to no experience in the company.

However, this freedom ends with the repayment plan, which requires weekly installments throughout the 24-week maximum loan duration. See alternative online business loan possibilities if you require a longer payback time.

Revolving business lines of credit up to $150,000 are available from Fundbox with 12- or 24-week payback intervals. Additionally, Fundbox is preparing to roll out a term loan for small businesses.

4. Bluevine

Small business owners searching for short-term operating capital may find Bluevine, a financial technology company, to be a helpful alternative. A commercial bank with a Utah charter and FDIC membership, Celtic Bank is the issuer of the credit line for Bluevine.

Borrowers may link their company bank accounts through Bluevine's straightforward application procedure, and in the majority of situations, they obtain a decision within minutes.

Although company owners can sign up for Bluevine business checking, they are not required to do so to be approved for financing.

Revolving business lines of credit up to $250,000 are available from Bluevine with six- or 12-month payback intervals.

5. OneMain Financial

Personal loans are offered by OneMain Financial to customers with acceptable to subpar credit.

Even though OneMain's average loan amount is often small, certain borrowers who might not be accepted by traditional banks or other online lenders may find it simpler to get a loan via OneMain.

OneMain Financial provides both unsecured and secured loans, which is fantastic for borrowers with troubled finances. Secured loans need you to put up collateral for your loan, but they're sometimes simpler to qualify for.

You may acquire the money you need quickly since, according to OneMain, the typical turnaround time from application to funding is just one day.

What Is A Personal Loan?

A personal loan comprises money that can be used for anything other than investing or paying for school. They are typically used to pay for emergency or family-related costs, fund home upgrades, or consolidate debt.

Two categories of personal loans exist: With an unsecured loan, you can borrow money and repay it over time at a set interest rate.

When applying for a secured personal loan, you must pledge an asset as security. Unsecured loans are thought to be riskier, thus their interest rates will probably be higher. Most personal loans with bad credit are unsecured in the new economy.

Leveraging Loans Conclusion

Generally speaking, the company loan with the best conditions and lowest rates is the best for business loans. However, other elements, such as the time to invest and the credentials of your company, might influence which choice you should pick.

To discover the best small-business loan for your company, we advise evaluating options.