Genome is a financial service that allows you to open a personal or business account for maximum control and transparency of financial flows, both corporate and individual. The service works online, and in addition to tools for working with corporate funds, it provides many additional services that make the platform unique and much more convenient than your traditional banking experience. We review more about Genome below.

Business Account Rules And Fees

When using a business account, the platform keeps a fee, depending on the type of company, the risk of the organization or industry as a whole, and other factors. Thus, the financial service provides an individual approach to needs, opportunities, and other factors. The amount of the subscription fee also depends on whether the business account user is a resident of the EU (Location) or physically located outside Europe. Thus, according to https://genome.eu/, EU residents do not pay any monthly subscription fee for using eWallet or business account, while non-residents wishing to access bank transfer money and other services are obliged to pay a monthly fee of 20 euros.

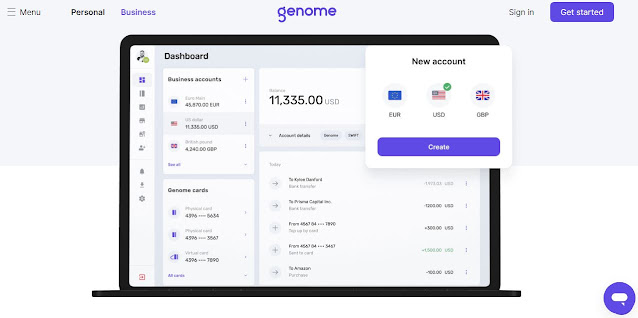

Not only can you use your Genome Account online but also withdraw cash at any ATM in Europe. To make Bank Transfer money and cash withdrawals as easy as possible, you can issue a virtual or physical card for business or personal use, depending on your internal corporate policies or realities.

Genome Financial Service: Main Features Reviewed

You can learn about all the features and benefits of Genome from https://blog.genome.eu/, where all the information is presented in great detail. In short, the platform offers you everything you need for successful financial transactions in the company:

● Convenient and profitable options for international money transfers.

● Fast receipt and crediting of payments.

● Real-time transaction tracking, notification system.

● Possibility to add to one account five IBANs for multi-currency payments.

● Opportunity to open a seller's account for payments to customers, etc.

Manage your financial flows without undue effort and restrictions!

Data Protection In Genome Business Account

Protecting and encrypting information for any financial service is paramount. However, in Genome Account, this is implemented with special seriousness. To preserve the integrity of money and data confidentiality, the system automatically detects attempts to forge a digital signature, notices various fraudulent schemes, and requires mandatory two-factor authentication.

If you decide to open business account, you can be sure of absolute security. The financial service relies on the 3D Secure user identification system, TLS/SSL encryption, and tokenization. The platform is regulated by the National Bank of Lithuania, and its security standards apply to the entire territory where the Financial Service Genome provides its services, i.e. even in Bulgaria these rules and reliability remain in force. Therefore, when deciding to open business account, you choose high standards for the circulation and storage of electronic or digital assets.

Extra Features Of Genome Business Account

In addition to being the best financial service with the most convenient tools you may need, Genome is also an eWallet. It opens in any web browser as well as in a mobile application available to holders of Android and iOS devices. This is very convenient when you are on the road and do not have access to a PC.

In addition to personal access, you can add employees of your organization to your business account, giving them different levels of access (roles). If necessary, you can revoke access to the corporate account for some people and assign others, so there is no problem.

Finally, your business account has prepared a pleasant surprise for you. In your profile, there is an opportunity to copy the referral link and send it to acquaintances, colleagues, and other entrepreneurs. Once a new business account is registered at this link and your partner starts using it, you will receive 10% of the amount paid for opening an account as well as commissions for transfers or foreign exchange transactions in USD, EUR, or pounds sterling. So, you earn even more on partnerships!